Is the Console War Finally Over?

- By Aaron

- Mar 15,2025

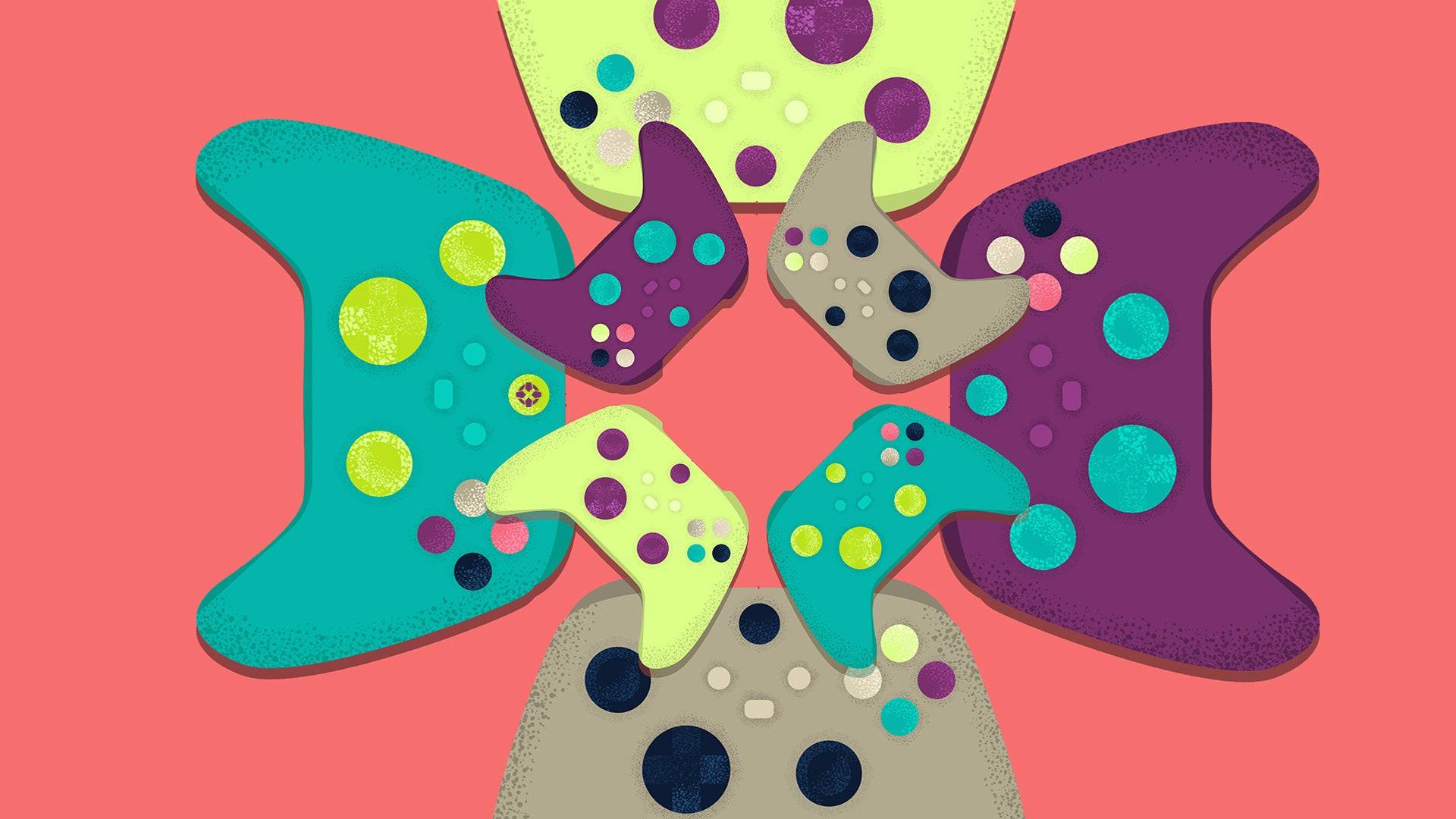

The age-old question: PlayStation or Xbox? This debate has raged for years, sparking countless online discussions and heated arguments among friends. While PC and Nintendo loyalists exist, the rivalry between Sony and Microsoft has largely defined the gaming landscape for two decades. But has this "console war" truly ended? The industry has undergone a seismic shift, driven by the rise of mobile gaming and a younger generation's tech-savviness. The battlefield is unrecognizable, and a surprising victor may have emerged.

The video game industry's financial success is undeniable. In 2019, global revenue reached $285 billion, exploding to $475 billion in 2023—surpassing the combined revenue of the film and music industries. This growth shows no signs of slowing, with projections nearing $700 billion by 2029. This lucrative market has attracted Hollywood A-listers like Mads Mikkelsen, Keanu Reeves, and Willem Dafoe, reflecting the elevated status of video games. Even Disney, with its $1.5 billion investment in Epic Games, is vying for a significant stake in the gaming world.

Despite aiming for superiority, the Xbox Series X and S haven't quite lived up to expectations. Sales lag significantly behind the Xbox One, a worrying sign, especially considering industry expert Mat Piscatella's prediction that this console generation has peaked. 2024 sales figures paint a stark picture: Xbox Series X/S sales fell short of 2.5 million units, dwarfed by the PlayStation 5's first-quarter sales alone (also around 2.5 million). Rumors of Xbox closing its physical game distribution department and potentially withdrawing from the EMEA console market further fuel concerns. This suggests a strategic retreat, but the reality is more nuanced.

Xbox hasn't retreated; it has essentially surrendered the console war. Internal Microsoft documents revealed the company doesn't believe it ever had a realistic chance against Sony. So, what's a console-centric company to do when its latest model underperforms and its parent company acknowledges failure? It pivots away from the console business.

Xbox Game Pass has become a central focus. Leaked documents detail the substantial costs associated with bringing AAA titles like *Grand Theft Auto 5* and *Star Wars Jedi: Survivor* to the subscription service. This demonstrates a commitment to cloud gaming, a strategy reinforced by the "This Is An Xbox" advertising campaign, which reimagines Xbox not as a console, but as an always-accessible service with complementary hardware.

This reimagining extends beyond traditional consoles. Rumors of an Xbox handheld, supported by leaked documents hinting at a next-gen hybrid cloud gaming platform, suggest a broader hardware strategy. Microsoft's shift is evident in its mobile game store plans and Phil Spencer's acknowledgment of mobile gaming's dominance. The new approach is simple: Xbox is a gaming brand accessible anytime, anywhere.

Why this pivot? While Xbox has struggled, the console market's dominance is waning. In 2024, over 1.93 billion of the estimated 3.3 billion gamers played on mobile devices. Mobile gaming isn't just casual; it's the dominant force, particularly among Gen Z and Gen Alpha. Mobile games comprised $92.5 billion (50%) of the $184.3 billion video game market in 2024, eclipsing consoles at $50.3 billion (27%). This explains Microsoft's desire to transform phones into Xbox experiences.

This isn't a recent development. By 2013, the Asian mobile gaming market significantly outpaced the West. Titles like *Puzzle & Dragons* and *Candy Crush Saga* outperformed *Grand Theft Auto 5* in revenue. Five of the highest-grossing games of the 2010s were mobile games, highlighting the shift's early stages.

Mobile isn't the only challenger. PC gaming has also seen substantial growth since 2014, reaching 1.86 billion players in 2024. Increased technological literacy among gamers, fueled by online communities, has contributed to this rise. However, despite this growth, the PC market's value in 2024 ($41.5 billion) still lags behind consoles, highlighting a potentially slowing market.

Beyond mobile and PC, PlayStation's success presents another challenge for Xbox. Sony's latest report boasts 65 million PS5 sales, significantly outpacing Xbox Series X/S sales. Sony's Game and Network Services also saw a profit increase, fueled by strong first-party titles. Ampere Analysis projects 106.9 million PS5 sales by 2029, compared to Microsoft's estimated 56-59 million Xbox Series X/S sales. To regain competitiveness, Xbox needs to drastically improve sales and profitability of its exclusives. Given Phil Spencer's openness to releasing Xbox titles on PlayStation and Switch, PlayStation's dominance seems solidified.

However, the PS5 isn't without its weaknesses. Around 50% of PlayStation users still play on PS4s, suggesting a lack of compelling PS5 exclusives. Of the top 20 best-selling games in the U.S. in 2024, only one is truly PS5-exclusive. The PS5 Pro's release also received a mixed reception, perceived as an early and overpriced upgrade. This lack of must-have titles hinders the PS5's appeal, although *Grand Theft Auto 6*’s release could change that.

AnswerSee ResultsSo, is the console war over? Microsoft seemingly never believed it had a chance against Sony. Sony's success is undeniable, but the PS5 lacks the revolutionary leap to definitively claim victory. The true winner might be those who avoided the conflict altogether. The rise of mobile gaming, with companies like Tencent making significant acquisitions, points to a future defined by cloud gaming infrastructure rather than hardware power. The console war may be over, but the mobile gaming battle—and many smaller conflicts—has just begun.

Latest News

more >-

-

- Devs Revamp REPO's Overcharge & Scaling

- Jan 02,2026

-

-

- Final Fantasy 7 Rebirth PC pre-orders begin

- Jan 01,2026

-